THE LIVING WAGE SCAM

|

THE LIVING WAGE SCAM |

|

Lately, liberals have been talking about "living wage legislation". They want government to guarantee them a living. But it's not going to work, because it promises to create wealth out of nothing. And we all should know that such a thing is impossible.

It's a SCAM. This is because they cannot possibly deliver on their promise. Sure, they could pass the legislation...

But it can't possibly work!

The first thing we need to understand is what wealth really is. It is NOT having a lot of money. The government could print billions more dollars without creating any more wealth. This is because printing more bills simply makes each bill have a smaller real value.

Wealth is an accumulation of commodities that others want to buy.

Money is a way to store the value of the work you do, until you need to redeem it in the purchase of products.

Money is also a way to "make change". Imagine trying to purchase a bicycle with live pigs, when a bicycle is worth 2.5 live pigs. Money makes it easy to even out the uneven values of different products.

The value of money is not constant. It changes value, depending on the amount of currency the government prints, the population, and the amount of wealth the economy produces.

Living wage legislation is a guarantee that a person working at a job makes enough money to support his family.

It often expects a wage earner's salary to buy an amount of wealth larger than the amount of wealth produced by the work the wage earner did. That is, of course, impossible, because the amount of product wage earners buy cannot exceed the amount of product they make, and because the amount of money paid to a wage earner cannot exceed the amount of money the product of his work can be sold for.

It also guarantees a living to people who squander their labor on products that do not sell.

Let's look at it another way:

Let's look at it in yet another way:

Every time they raise the minimum wage, the product prices have to rise, so the employer can afford to pay the new wage.

It is an attempt to create wealth out of nothing. Of course, you can't do that, unless slavery is allowed. The worker can gain no more wealth from his work than the actual wealth his work creates.

Notice in the chart that all 4 flows must be equal in size. Otherwise, something is created out of nothing. Of course, either the worker or the employer can save or borrow money, but those are temporary, and must eventually balance out.

The ramifications of this are:

The amount of wealth a worker can buy is B, which equals:

B = (1 - T) * W

Where:

Put another way, the worker has to work 1 / (1 - T) times harder because of the tax rate T, to be able to purchase the same amount of wealth.

Examples cases:

| Tax rate | How much harder worker must work | % more work | comment |

|---|---|---|---|

| 0% | 1 times as hard as untaxed worker | 0% more work | Untaxed worker |

| 5% | 20/19 times as hard as untaxed worker | 5.3% more work | |

| 10% | 10/9 times as hard as untaxed worker | 11% more work | Ideal case. |

| 25% | 4/3 as hard as an untaxed worker | 33% more work. | |

| 33% | 3/2 as hard as an untaxed worker | 50% more work. | |

| 50% | twice as hard as an untaxed worker | 100% more work. | |

| 75% | 4 times as hard as an untaxed worker | 300% more work. | Close to actual US value (see below). |

| 90% | 10 times as hard as an untaxed worker | 900% more work. | |

| 100% | Must work infinitely hard. | But he won't work for nothing. |

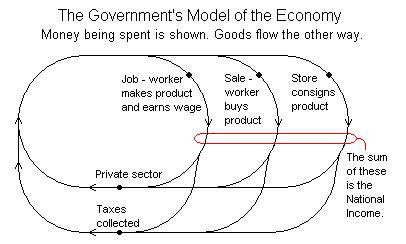

Here is how the government says the economy works, and how the government takes economic statistics. Notice that all segments of the economy operate in parallel, with the government taking about a third of each part:

According to THIS MODEL, the government takes a total of about 37 percent of most incomes, including business incomes. According to this model, the consumer gets to keep 63 percent of his income.

BUT ... The above model is WRONG!

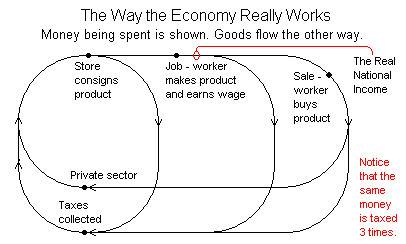

All business taxes are passed on to the consumer in higher prices. That means the following model of the economy is more accurate. All of the operating parts of the economy EXCEPT TAXATION are in series:

The worker is working three times as hard to make a living, because government is taking away over two thirds of his income. Business itself cannot be taxed, because business itself produces very little actual wealth, compared to work.

Or you can say that the worker gets to keep less than about a third of the wealth he creates. Government takes the rest. And the worker ends up working 3 to 4 times harder to make the ends meet.

But they are levied multiple times on the worker's income! And even 33 percent taken once is too much.

It works out right now that the average employee is paying 72 percent of his income in taxes. Only 28 percent of his income actually goes toward making the products he can buy.

See the above diagram. See how government siphons wealth from the same cash flow at least three times.

The employer is in just as much trouble as the employee, as demonstrated by all of the business closings.

And guess what? Government can't buy products either without paying all of those taxes hidden in the product prices either. So government is also not getting its money's worth!

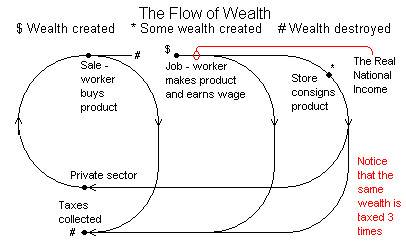

According to wealth theory, working creates wealth, while consumption and taxation use up or destroy wealth. So the flow of wealth in the economy looks like this:

The employee creates the wealth when he works to make the product. He is paid for the wealth he creates. His employer then sells the product to a store (or to a wholesaler, who sells it to the store). A worker then buys the product and CONSUMES it. The product is USED UP, as all products are, whether it is eaten, worn out, or weathered. The amount of wealth in it decreases, until there is no wealth left, and the product is used up or thrown out as trash.

But taxation also destroys wealth, by making the seller charge more for the product. The amount of wealth created by the worker remains the same, but it takes more wealth creation by the person who buys the product, because all of the multiple rounds of taxation have increased the price. Thus, government has destroyed some wealth because the worker's salary can't buy as much wealth as the wealth he created.

It can't increase the real income of the worker. Every time the living wage goes up, the employer must raise product prices to be able to pay the wage.

That would create hyperinflation, since the wage will never be able to catch up to the product price.

That would just make all of the factories close, since they can't afford to pay workers more than they take in from selling the products. The result would be a total economic collapse.

We saw a version of this in the 1970s, when government legislated that a gallon of gasoline could not be sold for more than a certain amount. When it suddenly cost more to make a gallon of gasoline than it could legally be sold for, nobody made any gasoline, and we had a gas shortage. Remember the gas lines? Remember the high inflation? Look what government did!

As soon as the government repealed its stupid price controls, everything got back to normal.

With a living wage and price controls, there would be product lines in every store. With National Health Care, there would be doctor lines. It would be like the Soviet Union was. You can't legislate your way out of the market economy and win. A side effect ALWAYS undoes the desired result of the legislation.

You can't have your cake and eat it too. Every dollar government takes away from the worker in taxation is a dollar that worker does not have to support his family. It is also a dollar's worth of wealth that is effectively destroyed by removing it from the economy.

Anyone who thinks that any of these are necessities should donate to such programs, rather than demanding that government do them.

|

YOU CAN'T HAVE YOUR CAKE

|

|

Links: